What is Transaction Auto-Categorization? How Does Fincent’s Auto-Categorization Feature Work?

Read how transaction auto-categorization helps you understand your finances better and how Fincent is using AI to improve the process.

There’s a reason why businesses (not to mention individuals) prefer outsourced accounting and bookkeeping services. The entire process has too many moving parts and can quickly get complex.

Take transaction categorization for example. Any business’ financial platform gathers a lot of data from multiple sources – think bank statements, receipts, invoices, credit card statements, etc. All transactions coming in from different sources need to be categorized for you to understand your finances better and eventually make better financial decision.

Moreover, transaction categorization can be incredibly helpful when it comes to fraud prevention. With nearly 70% of businesses facing a rise in fraud cases in 2023, it’s important for businesses to understand cash inflows and outflows.

But, like every other bookkeeping process, manual transaction categorization is complicated and time-consuming.

Therefore, in this blog we are going to talk about automated transaction categorization and how Fincent is using cutting-edge technology to improve the process for businesses.

What is Transaction Auto-Categorization?

Transaction auto-categorization, or automated transaction categorization, is the process of automatically categorizing transactions using machine learning (ML) algorithms and predefined rules. Each financial transaction is categorized based on its purpose, nature, and type.

Why it Matters – Benefits of Automated Transaction Categorization

- Fraud detection and prevention: Streamlined transaction categorization can help you identify potential risks and act before fraudulent activities occur. Automation ensures that transactions are categorized properly, and any anomaly is flagged for review.

- Accurate financial reporting: Transaction categorization is an important process and essential for accurate financial reporting. What you see as different ‘Accounts’ on financial statements is the result of meticulous transaction categorization. Automated transaction categorization improves this process and enhances the accuracy of financial reports.

- Improved customer insights: The process of categorizing transactions can give you unique insights into the spending habits of your customers and their preferences. Based on these insights you tailor your services or products to better suit their needs. For example, you can segment your audiences better by categorizing transactions and target relevant groups for your marketing campaigns, promotions, and loyalty programs.

How Fincent’s Transaction Auto-Categorization Feature Works

Most bookkeeping software use rules-based algorithms to classify transactions. Fincent was doing the same. However, our engineers quickly realized that the process of classifying transactions can be significantly enhanced by using large language models (LLMs).

The result?

Fincent has now upgraded its auto-categorization engine with a powerful AI-driven transaction classification system using LLMs. The new system has replaced the previous rule based-based auto-categorization logic. Fincent’s AI-driven transaction categorization system integrates semantic context, constant learning, and transparent insights for bookkeepers and businesses working with Fincent’s bookkeepers.

What’s new

- Fincent has a dedicated graphics processing unit (GPU) infrastructure, completely under our control, which means we can train AI models to better classify transactions. The dedicated GPU infrastructure further enables fast processing capabilities devoid of any latency issues.

- All your financial data never leaves Fincent’s system, meaning there is no threat of sensitive information being leaked.

- Fincent’s AI-powered transaction categorization system is fully self-hosted and doesn’t rely on external AI services providing you with enterprise-grade security.

Workflow

Here’s how Fincent’s systems works to transform transaction categorization:

- Fincent’s platform gathers all your historical transaction data and company-specific chart of accounts (COA) information. All the historical data is stored on our servers.

- All the stored information enables Fincent’s system to generate rule-based pattern recognition to classify transactions.

- All new uncategorized transactions go through the following process:

- Matched against historical context to identify the closest match. Category is assigned if a match is found.

- If not, LLM patterns and vendor rules are applied to propose a match category.

- In case a match is still not found, bookkeepers use LLM directly to classify from raw transaction data.

In simple terms, whenever a transaction flows into Fincent’s system, our LLM analyses key data points like transaction type, description, amount, and date.

Before a transaction is recorded, our AI runs billions of probability scenarios, factoring in the client’s industry, transaction nature, and historical trends.

The transaction is recorded only if the result exceeds our industry-leading accuracy threshold (set higher than our competitors).

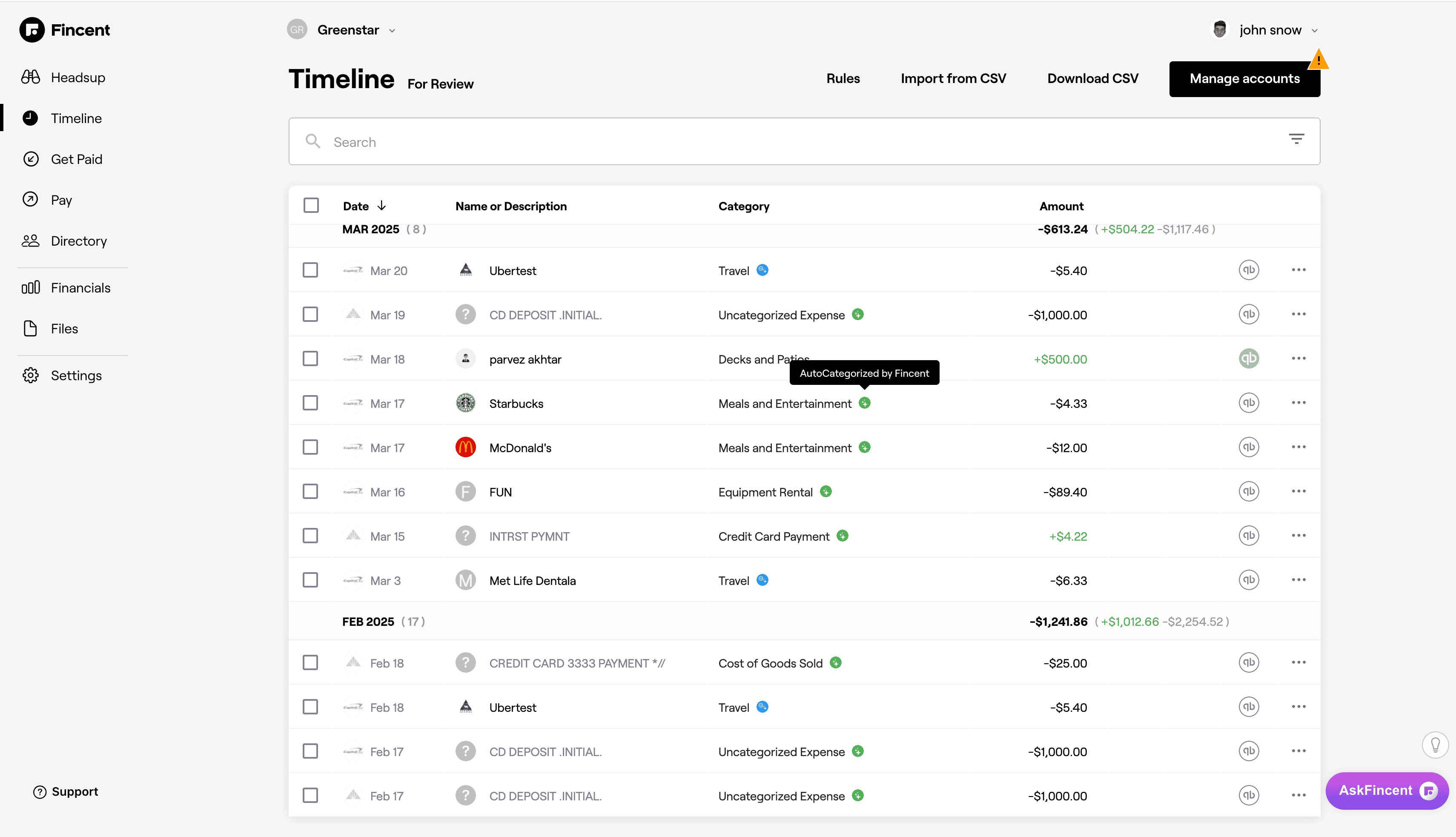

You can then view the recorded transaction with accurate classification on the Timeline tab of Fincent’s platform.

AI + human expertise

Fincent uses a combination of AI and human bookkeepers to ensure all the transactions are categorized and recorded correctly.

- After the transaction is recorded by AI-driven algorithms, our expert bookkeepers ensure to review it, minimizing errors.

- Your dedicated team leader performs a final review to ensure nothing is missed at the end of the month further enhancing accuracy.

How context learning helps us improve transaction categorization

- Our company-specific training model enhances accuracy for each individual client. For instance, whenever a new transaction is classified, the information goes back to the LLM to enhance future categorization instances.

- We have isolated learning environments that don’t share data across multiple companies.

- Ous continuous improvement model is specific to each client’s transaction patterns. All data for a specific company is fed back into Fincent’s system, ensuring future matches automatically get enriched.

Fincent’s AI driven transaction classification system is already helping clients. We’ve seen the AI-driven model deliver 85% accuracy on its own. The remaining 15% is taken care of by our two-layer human review process.

The entire process ensures that your books are spotless and allows you to better understand your finances.

Final Thoughts

Modern businesses can benefit a lot from automated transaction categorization, as it gives you clean books and reduces manual grind. The use of AL and ML technologies significantly reduces errors, detects anomalies before they become problems, and inherently streamlines the entire process of transaction classification.

With Fincent, you can take things a step further and let our system and bookkeepers do all the work. This means that you can get enhanced insights into your finances without having to any heavy lifting. Our enterprise-grade infrastructure and data security set you apart from competitors who rely on external AI services.

Automate Transaction Categorization with Fincent

Get a clearer picture of your finances to grow faster.

Related articles

How to do bookkeeping for real estate business

Keeping track of real-estate investments/businesses’ financial health helps you be profitable, receive tax benefits, and make sound financial decisions in difficult times.

Read moreFounder’s Guide to Annual Financial Planning

Learn what financial planning is, why it matters, and its key components to help your business grow better.

Read more