- Glossary

- Balance Sheet

Balance Sheet

The balance sheet is a crucial financial statement in accounting and financial modeling, representing one of the three basic statements. It showcases a company's assets and how they are financed, whether through equity or debt. This statement may also be known as a statement of net worth or financial position.

Utilizing balance sheets alongside other important financial accounts can enable fundamental analysis and determination of financial ratios.

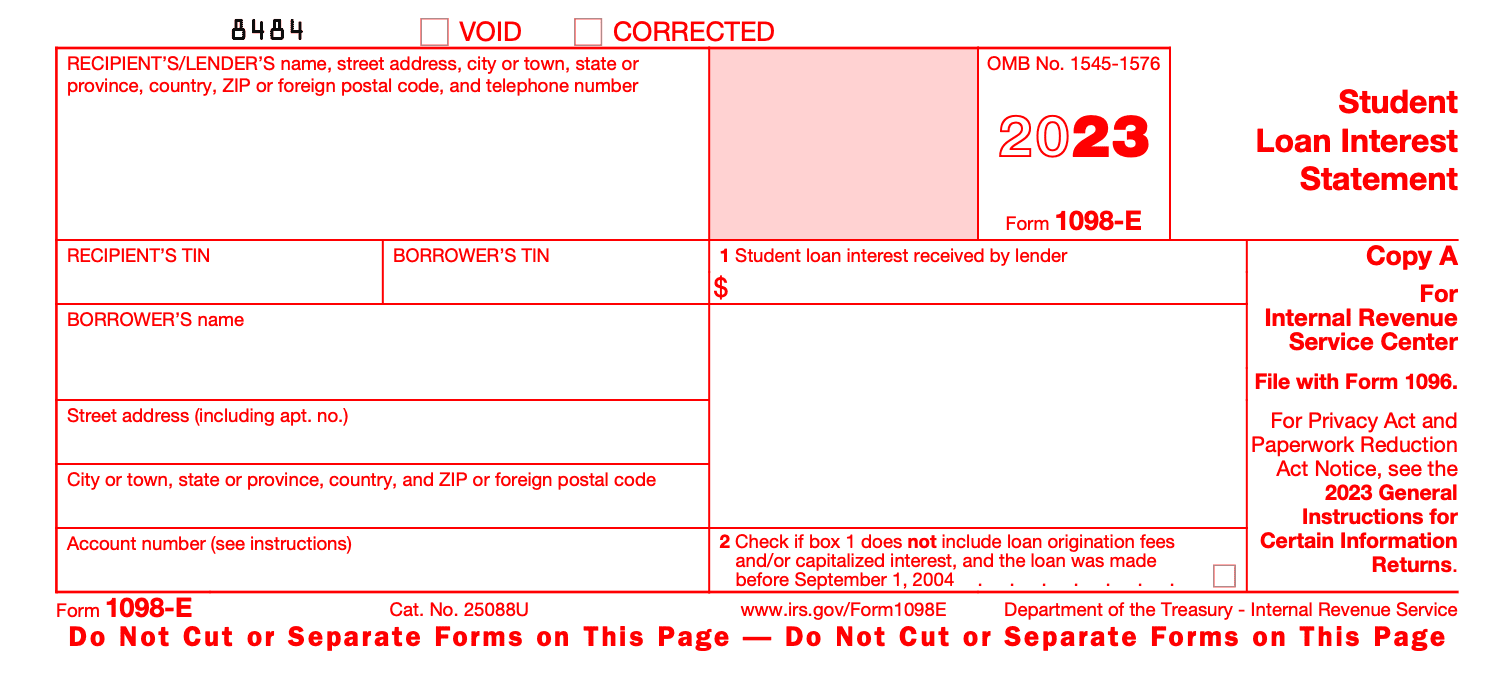

Test image below:

The balance sheet is based on the fundamental equation:

Assets = Liabilities + Equity.

How The Balance Sheet Is Structured?

Current Assets

- Cash and Equivalents: Cash is the first item on the balance sheet since it is the most movable of all assets. Additionally grouped under this line item are assets with short-term maturities, known as Cash Equivalents.

- Accounts Receivable: This account reflects the remaining balance of all sales revenue that has not yet been paid in full, less any allowances for shaky accounts.

- Inventory: Finished commodities, unfinished things, and raw materials are all included in inventory. This account is used by the business to record product sales, usually beneath the cost of goods sold in the income statement.

Non-Current Assets

- Plant, Property, and Equipment (PP&E): A company's tangible fixed assets are recorded.

- Intangible Assets: All of the company's intangible fixed assets are included in this line item, including things like patents, licenses, and trade secrets that may or may not be traceable.

Current Liabilities

- Accounts Payable: The amount that a business owes suppliers for goods or services that were acquired on credit is known as accounts payables, or AP.

- Current Debt/Notes Payable: Includes commitments that are not accounts payable that are due within a year or during the company's operating cycle (whichever is longest).

- **Current Portion of Long-Term Debt: **This account might or might not be combined with the account mentioned above, Current Debt.

Non-Current Liabilities

- Bonds Payable: Any bonds the corporation has issued are included in this account along with their amortized value.

- **Long-Term Debt: **This account contains all the long-term debt (excluding the current portion if that account is present under current liabilities).

- Shareholders’ Equity

- Share Capital: This represents the amount of money that shareholders have staked in the business. A shareholder's initial investment in a firm is often cash.

- Retained Earnings: This is the total net income that the business chooses to retain. A business may distribute dividends from its net income each period.

Importance Of The Balance Sheet

Four important financial performance metrics include:

- Liquidity - A company's liquidity can be determined by comparing its current assets to current liabilities. The corporation should have more current assets than current liabilities to meet its immediate obligations. Financial liquidity measurements include the current ratio and quick ratio.

- Leverage - By examining a company's financing structure, one can determine how much leverage it has and, consequently, how much financial risk it is incurring. Leverage on the balance sheet is frequently evaluated by comparing debt to equity and debt to total capital.

- Efficiency - The income statement and balance sheet can be used to determine how effectively a company utilizes its assets. For instance, the Asset Turnover Ratio, which measures how well a corporation converts assets into revenue, is calculated by dividing revenue by the average total assets. The working capital cycle also demonstrates how effectively a business controls its short-term cash flow.

- Rates of Return - You can assess a company's ability to create returns by looking at its balance sheet. For instance, dividing net income by shareholders' equity (ROE), net income by total assets (ROA), and net income by debt plus equity (D+E) all generate Return on Equity (ROE), Return on Assets (ROA), and Return on Invested Capital (ROI), respectively (ROIC).